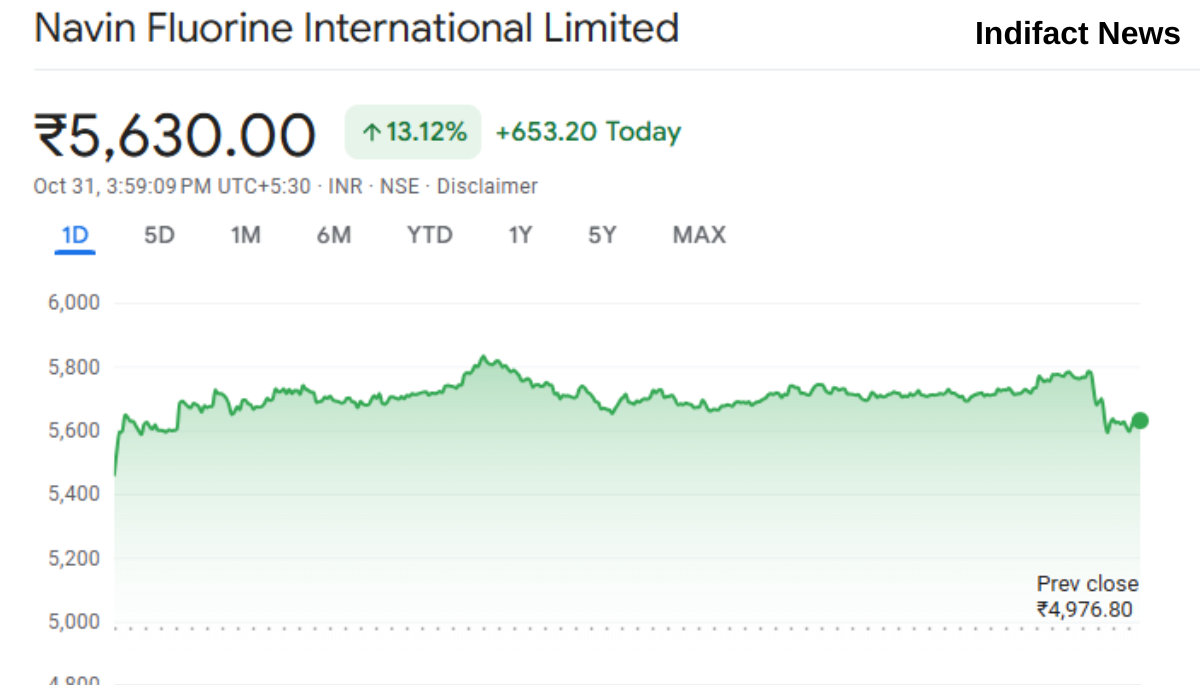

On October 31, 2025, the Indian stock market witnessed a powerful display of institutional conviction as shares of Navin Fluorine Stock 13.12% Gain International Limited (NFIL) soared, concluding the trading day with a dramatic gain of 13.12%, translating to an increase of ₹653.20 per share. The stock touched a fresh 52-week and all-time high of ₹5,839.00.

This was more than just a momentary blip; it was a decisive trend reversal following four days of decline, fueled by massive volume 5.52 million shares traded, dwarfing the 20-day average of 85.50 thousand shares. When we see trading activity this fierce, it is a clear signal that sophisticated investors believe something fundamental has changed. The question every investor must ask is: what confluence of events transformed this specialty chemicals player into a stock capable of such a sudden and sharp market re-rating?

The Navin Fluorine Stock 653.20 Gain explosive rally was not just driven by market exuberance; it was validated by three powerful, interconnected drivers: a stellar financial performance in the September quarter (Q2 FY26), a critical strategic entry into the future of data center cooling, and the successful execution of its long-term strategy centered on fluorination technology. In essence, NFIL is not just selling chemical products; it is marketing specialized solutions vital to the global pharmaceutical, agrochemical, and now, the artificial intelligence ecosystems.

The Quarterly Eruption: Decoding the Financial Earthquake

The Navin Fluorine Stock 653.20 Gain immediate spark for the October 31 surge was the company’s Q2 FY26 financial results, which presented a picture of unprecedented profitability and robust operational growth across all divisions.

A Margin Masterclass: The Shift to High-Value Products

The Navin Fluorine Stock 653.20 Gain standout figure from the latest quarter was the massive leap in profitability. NFIL reported operating earnings before interest, taxes, depreciation, and amortization (EBITDA) of ₹246 crore, representing an astounding 129% increase year-over-year (YoY). Even more compelling, the operating EBITDA margin expanded by 1,176 basis points, reaching a record 32.5%.

The ability of a manufacturing company to suddenly improve its margins by over 11 percentage points within a single year is typically not achieved by volume growth alone. It demonstrates a profound and successful shift in the product mix towards high-value, high-margin offerings. This superior operational leverage suggests that Navin Fluorine Stock 653.20 Gain has successfully monetized its complex, specialized chemistry capabilities, commanding better pricing power and efficiency.

Revenue in Navin Fluorine Stock 653.20 Gain Q2 FY26 stood at ₹758 crore, up 46% YoY, while consolidated net profit surged an even more impressive 152% YoY to ₹148 crore. This stellar performance prompted brokerages, such as Axis Securities, to immediately upgrade their ratings and raise the target price on the stock, expecting the strong momentum to sustain into the second half of FY26 (2HFY26). Management further endorsed this optimism by raising the full-year FY26 EBITDA guidance to a strong range of 28-30% from the earlier estimate of around 25%.

The Power of Three: Segmental Growth Drivers

Contract Development and Manufacturing (CDMO/Navin Molecular): This high-margin segment acted as the primary growth accelerator, logging a staggering 97% to 98% YoY surge in revenue. This division, which provides custom synthesis and manufacturing services to global innovator clients in pharmaceuticals and agrochemicals, benefits from strong order visibility extending through FY27. The successful scale-up orders received for supplies in Q3 and Q4 FY26 confirm robust demand and pipeline maturity. Specialty Chemicals: This segment, focused on niche fluorine-based molecules, reported a robust 39% YoY growth. The division is poised for accelerated performance in the coming quarters, supported by new molecule launches and capacity expansion projects. High-Performance Products (HPP): Including refrigerants and inorganic fluorides, this traditional segment still delivered a strong 38% YoY growth, driven by volume gains and improved price realizations.

The Navin Fluorine Stock 653.20 Gain disproportionate growth of the CDMO and Specialty segments validates the narrative that NFIL is successfully shedding its reliance on cyclical, low-margin products and positioning itself as an advanced intermediate provider.

Cooling the Intelligence Boom: The Strategic AI Pivot

While the quarterly numbers provided the ammunition for the immediate rally, the true long-term value narrative is tied to Navin Fluorine Stock 653.20 Gain’s breathtaking strategic maneuver into the heart of the artificial intelligence boom.

The Chemours Coup and the Thermal Challenge

The critical announcement regarding the strategic agreement with global chemistry leader Chemours Company to manufacture the specialized Opteon two-phase immersion cooling fluid is a monumental development. This liquid cooling technology is essential for managing the skyrocketing heat loads generated by advanced data centers housing next-generation AI chips. As the CEO of Chemours noted, the chips alone cannot deliver the AI boom; the extreme computing demands require a revolutionary, integrated approach to cooling.

Navin Fluorine Stock 653.20 Gain is leveraging its mastery of fluorination to address an existential problem in the global technology infrastructure. To facilitate this venture, NFIL will establish a new manufacturing facility in Surat, Gujarat. The total estimated capital expenditure (CapEx) for this facility is $14 million, with Chemours contributing $5 million, effectively de-risking a significant portion of the initial investment for NFIL. Production is slated to commence in the first quarter of FY27 (April–June 2026).

A Sustainable Moat in Advanced Materials

Navin Fluorine Stock 653.20 Gain this partnership immediately catapults NFIL into a high-growth, technology-driven supply chain, far removed from traditional chemical cycles. The Opteon fluid is not merely a technical solution; it is a sustainable one. The fluid features an ultra-low Global Warming Potential (GWP of 10) and boasts exceptional energy efficiency, with a Power Usage Effectiveness (PUE) approaching.

The move is strategically brilliant because it proves Navin Fluorine Stock 653.20 Gain’s ability to apply its deep chemical expertise to a cutting-edge industrial problem. By stepping into AI cooling, NFIL is showing its capability to create a highly valued, non-cyclical revenue stream, protected by technological complexity and anchored by a high-commitment global customer. This diversification significantly strengthens the company’s profile as a provider of advanced, future-ready materials.

The Fluorine Fortress: NFIL’s Invisible Technological Moat

To understand Navin Fluorine Stock 653.20 Gain’s sustained margin superiority and its ability to land contracts like the one with Chemours, one must appreciate the sheer difficulty and specialization required in its core technology: fluorination chemistry.

The Mastery of High-Pressure Chemistry

Navin Fluorine Stock 653.20 Gain International, and its contract division Navin Molecular, capitalize on over 50 years of experience as a leading global supplier and innovator in specialty fluorochemicals. Fluorine is a notoriously difficult element to handle and incorporate into complex molecules, yet it is often critical for enhancing the efficacy, stability, and bioavailability of active ingredients in modern pharmaceuticals and agrochemicals.

Navin Fluorine Stock 653.20 Gain’s technological expertise spans highly specialized, high-risk processes, including fluorinations using corrosive or hazardous reagents like anhydrous hydrogen fluoride (HF), sulfur tetrafluoride (SF4) under high pressure, and fluorine (F2) gas. These are not standard chemical processes; they represent a formidable barrier to entry, often referred to as a “chemistry moat.”

The company’s Contract Development and Manufacturing Organisation (CDMO) model thrives on this specialization, providing customers with comprehensive support and cGMP high-capacity facilities, with the proven track record needed to scale complex fluorinated intermediates. Furthermore, NFIL’s pilot facility in Surat is explicitly designed to simulate full-scale production conditions, ensuring a seamless and reliable transition from lab-scale R&D to commercial manufacturing a capability global innovators highly value.

The Capex Blueprint: Investing in Tomorrow’s Revenue

The financial results show present success, but the CapEx plan dictates future growth. Navin Fluorine Stock 653.20 Gain has budgeted a substantial capital expenditure of ₹600–700 crore for FY26, largely funded internally, underscoring management’s confidence in its long-term strategy.

Key Investments Underpinning Future Growth

HPP and the Kigali Transition: A significant ₹237 crore CapEx was approved for setting up an additional 15,000 metric tonnes per annum (MTPA) capacity for HFC-32 (R32) at the Surat unit, targeting commissioning by Q3 FY27.

Specialty/CDMO Capacity: Investments include ₹75 crore for debottlenecking the Multi-Purpose Plant (MPP) facility at Dahej and a substantial ₹288 crore allocated for the cGMP4 CapEx (with Phase 1 of ₹160 crore expected to commission by the end of Q3 FY26).

Navigating the Kigali Protocol: Risk Management

The investment in R32 capacity is highly strategic within the context of global environmental regulation. The Kigali Amendment to the Montreal Protocol mandates a phase-down of high Global Warming Potential (GWP) hydrofluorocarbons (HFCs) by over 80% in the next three decades. HFCs were initially substitutes for ozone-depleting substances, but their high GWP makes them potent greenhouse gases.

The R32 compound, which NFIL is expanding capacity for, is a lower-GWP refrigerant. This investment allows NFIL to strategically cater to the surging, immediate demand for air conditioning and refrigeration in developing economies, while minimizing regulatory obsolescence risk. By focusing on a transitional compound (R32) for current high-volume markets and simultaneously developing the ultra-low GWP solution (Opteon) for the future AI cooling segment, Navin Fluorine Stock 653.20 Gain manages regulatory headwinds while maximizing revenue streams during the global transition period.

The management is leveraging domestic policy tailwinds as well. Broader government initiatives, such as the Production-Linked Incentive (PLI) schemes and the ‘Make in India’ movement, seek to boost domestic agrochemical manufacturing and reduce reliance on imports, particularly from China. NFIL, with its advanced manufacturing capabilities and focus on import substitution, is perfectly positioned to capture this shifting geopolitical and supply chain landscape.

The Investor’s Dilemma: Valuation, Volatility, and the Road Ahead

Following the Navin Fluorine Stock 653.20 Gain massive surge, the stock naturally enters a zone of elevated valuation. The company’s financial metrics, management efficiency (Return on Capital Employed of 16.05%), and low debt-to-EBITDA ratio (1.08 times) are robust [7]. However, the current market price (around ₹5,687) trades significantly above the consensus analyst price target of ₹4,977.38, suggesting a theoretical downside of 12.48% based purely on pre-rally consensus estimates.

Why, then, did the stock rally so hard? The market appears to be employing a Sum-of-the-Parts (SOTP) valuation, applying a much higher growth multiple to the newly validated, high-technology segments (CDMO and AI cooling) than traditional brokerage models have yet factored in. Investors are not buying NFIL based on today’s consensus earnings; they are purchasing the discounted future earnings power derived from the ₹600–700 crore CapEx pipeline and the strategic entry into the AI supply chain.

The Navin Fluorine Stock 653.20 Gain high volatility (68.13% intraday) reflects the ongoing battle between value investors and growth investors. However, the high institutional holdings, standing at 51.73%, suggest that sophisticated, long-term capital strongly believes in the strategic narrative.

Conclusion: Execution is the Ultimate Multiplier

The monumental stock surge of Navin Fluorine Stock 653.20 Gain International on October 31, 2025, is deeply rooted in strong fundamentals and a masterful strategic pivot. The company’s record Q2 performance provided the necessary validation, confirming superior operating leverage driven by near-100% growth in its high-margin CDMO segment.

Critically, Navin Fluorine Stock 653.20 Gain has successfully demonstrated its capacity to transition from a specialized Indian chemical player to a global partner in advanced materials, securing a foothold in the explosive AI data center market via its partnership with Chemours. By simultaneously managing the HFC regulatory transition and aggressively expanding high-value specialty chemical capacity, NFIL has established a clear pathway for sustained, non-cyclical growth into FY27 and beyond.

The only remaining risk lies squarely in execution. If NFIL delivers flawlessly on its ambitious CapEx plan, commissioning the Opteon, R32, and cGMP4 facilities on time and within budget, the premium valuation observed today will likely cease to be a premium, instead becoming the established baseline for an advanced, future-ready chemical powerhouse.