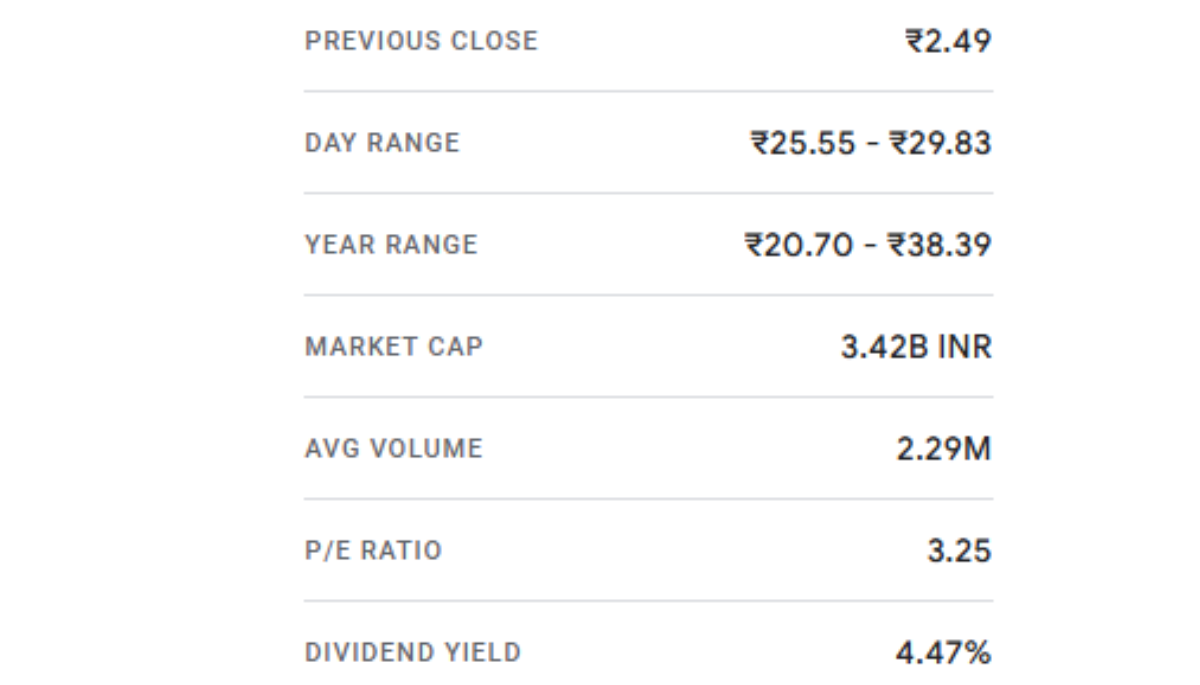

The Fineotex Chemical Stock Gain Today 1100% financial world was recently stunned by a truly spectacular headline: Fineotex Chemical Ltd. stock registering an astronomical gain of 1,099.92%, vaulting from a previous close allegedly near ₹2.49 to trade within a day range of ₹25.55 to ₹29.83. The immediate question for any investor, journalist, or market observer must be: Was this the consequence of a revolutionary discovery that fundamentally transformed the company overnight, or are we simply witnessing the sound of a financial calculator breaking?

Investigative analysis confirms the latter. The conflict between the sensational reported percentage gain and the actual trading price reveals a statistical anomaly, not a genuine explosion of corporate value. The source of this massive discrepancy is traced directly to Fineotex Chemical Stock Gain Today 1100%.’s (FCL) recent, strategic dual corporate actions: a substantial 4:1 Bonus Issue followed by a 1:2 Stock Split.

To Fineotex Chemical Stock Gain Today 1100% comprehend the mathematics, consider the corporate action playbook unveiled in October 2025. The company first issued four bonus shares for every one existing share (4:1 bonus), effectively multiplying the share count by five. Subsequently, the company executed a stock split, dividing the face value of the equity shares from ₹2 per share to ₹1 per share (a 1:2 split). The cumulative effect of these two actions resulted in a ten-fold increase (5 shares times 2 splits = 10 shares) in the total number of outstanding shares. Consequently, the share price had to be adjusted downward by approximately 90%.

Before the record date of October 31, 2025, FCL’s share was trading around ₹249.04. Applying the 10x adjustment factor means the theoretical post-adjustment price should be roughly ₹24.90. This price aligns perfectly with the observed daily trading range of ₹25.55 to ₹29.83. Therefore, the sensational 1,100% headline gain was generated by comparing the current post-adjusted trading price against an erroneously low figure (like ₹2.49), likely stemming from a data reconciliation error, failing to factor in the full effect of the dual corporate action. The true market movement on the day was modest, but the structural transformation beneath the surface was profound.

Investor Education: Making the Stock Accessible

Fineotex Chemical Stock Gain Today 1100% management implemented the dual action with clear, strategic intent: to reward long-term shareholders, enhance overall liquidity, and critically, make the stock more affordable and appealing to a broader base of retail investors.

To Fineotex Chemical Stock Gain Today 1100% understand why this move matters, consider the “Pizza Slicing Analogy.” Imagine an investor owns one whole, expensive pizza priced at, say, ₹2,490. The bonus issue and stock split do not make the pizza itself any larger, as there is no change in the company’s overall net worth or capital structure. Instead, these actions simply cut that single expensive pizza into ten smaller, cheaper, and more accessible slices, each priced at approximately ₹249. This psychological lowering of the per-share price opens the door to greater participation and broadens the base of ownership, a process often associated with sustained performance in successful growth companies.

While both actions increase the number of shares, their financial mechanics differ subtly. A bonus issue draws upon the company’s accumulated reserves, capitalizing profits and reducing the company’s free reserves; the stock split, conversely, only reduces the face value per share in proportion to the split ratio. Regardless of the distinction, the outcome is the same for the investor: the total value of the holding remains constant, reinforcing the idea that this was a structural and technical play, designed to enhance market efficiency Fineotex Chemical Stock Gain Today 1100%.

| Corporate Action | Goal | Ratio/Value Change | Impact on Investor Holding (Example: 100 Shares) |

| Stock Split | Increase Liquidity/Affordability | Face Value ₹2 to ₹1 (1:2 Split) | 100 shares become 200 shares (Value constant) |

| Bonus Issue | Reward Shareholders/Utilize Reserves | 4:1 (4 bonus shares for every 1 held) | 200 shares become 1,000 shares (Value constant) |

| Net Effect | 10x Shares, 1/10th Price | 10x Total Shares Outstanding | 100 shares at ₹249 pre-adjustment become 1,000 shares at ₹25 post-adjustment. |

The Foundation: Dominance in Textile Auxiliaries

Fineotex Chemical Stock Gain Today 1100%’s success story is rooted in the specialty chemical industry, tracing its legacy back to its founding in 1979 by Mr. Surendra Tibrewala. Today, FCL stands as one of India’s largest publicly listed chemical companies, recognized for its world-class textile chemicals. The company operates as a specialty performance chemical leader, catering to the entire textile production value chain. This comprehensive coverage includes chemicals for pre-treatment, dyeing, printing, and finishing processes.

With over 450 product categories, Fineotex Chemical Stock Gain Today 1100% boasts significant operational scale, anchored by manufacturing facilities in Navi Mumbai and the new Ambernath plant in India, alongside its facility in Selangor, Malaysia. The company has strategically leveraged its textile base to diversify over time, incorporating segments such as FMCG (cleaning/hygiene), water treatment, and specialized oil and drilling fluids. However, the mainstay of the business remains the textile chemical range, providing a stable revenue foundation.

The Strategic Moat: Sustainability and Global Collaboration

A crucial determinant of Fineotex Chemical Stock Gain Today 1100%’s premium positioning is its proactive approach to sustainability and global partnership. The company’s core business is insulated from excessive price volatility by focusing on high-quality, certified products. This is exemplified by its strategic collaboration with Eurodye-CTC, a world-renowned European brand for specialized textile auxiliaries. Through this joint venture, FCL integrates Eurodye-CTC’s pre-treatment and dyeing products which meet stringent international quality standards into the Indian market.

The significance of these standards, such as REACH registration, GOTS, Bluesign, and Green Screen, extends far beyond simple environmental stewardship. Global textile buyers, particularly those in the EU and North America, increasingly mandate the use of certified, eco-friendly chemicals throughout their supply chains. By gaining immediate access to Eurodye-CTC’s accredited portfolio, Fineotex Chemical Stock Gain Today 1100% effectively provides a regulatory shield for its domestic clients, many of whom are heavily focused on exports. This ensures these clients can maintain crucial international compliance, positioning FCL not merely as a chemical supplier, but as a strategic partner that enables premium market access. This move reinforces FCL’s competitive advantage, ensuring the foundation of its textile business remains strong, relevant, and protected against commodity price pressures.

Leveraging Government Tailwinds: The PLI Scheme Effect

Fineotex Chemical Stock Gain Today 1100%’s trajectory aligns directly with India’s ambitions in the chemical sector, which is projected to grow at a robust CAGR of 9.3% and reach $300 billion by 2025. Specifically, the Indian specialty chemical segment, which FCL dominates, is projected to grow at nearly 11% CAGR. Government policies, especially the Production Linked Incentive (PLI) Scheme for Textiles, create a powerful structural demand driver.

Although Fineotex Chemical Stock Gain Today 1100% itself is not a direct beneficiary of the PLI subsidy, it benefits immensely as a critical enabler for the textile industry. The PLI scheme focuses heavily on promoting the production of Man-Made Fibre (MMF) apparel and technical textiles. Recent government amendments to the scheme dramatically lower the barriers to entry: the minimum investment requirement has been significantly reduced (e.g., from ₹300 crore to ₹150 crore for Part 1), and the incremental turnover requirement has been relaxed from 25% to 10%.

This Fineotex Chemical Stock Gain Today 1100% policy shift creates a wave of captive domestic demand. Lower investment thresholds mean that a larger pool of mid-sized textile companies can scale up their MMF and technical textile production faster. Since FCL specializes in the chemicals required for these exact processes across the entire value chain , this national structural push directly translates into increased, stabilized domestic order volumes. This influx of domestic demand acts as an essential buffer against persistent, unpredictable challenges like “geopolitical disruptions” and “delay in export orders” that analysts have recently noted.

The High-Margin Hunt: Moving Beyond the Textile Basket

While the textile segment provides stability, Fineotex Chemical Stock Gain Today 1100%‘s long-term high-growth story hinges on its strategic diversification into more lucrative industrial specialty segments. The company is actively focusing on Oil & Gas Chemicals and Water Treatment Chemicals. This shift is critical because the industrial specialty sector, unlike some consumer-facing chemical markets, typically commands higher gross margins and allows for longer, more resilient contractual relationships, justifying a potential re-rating of FCL’s overall valuation multiple. Management remains optimistic, positioning the company as a diversified specialty chemical player with a growing presence in high-margin industrial end-markets.

The Blue Chip Validation: Vendor Approvals as the Moat

The clearest signal that this pivot is moving from aspiration to reality is Fineotex Chemical Stock Gain Today 1100%‘s successful acquisition of vendor approvals from several global energy and oilfield service behemoths. FCL has secured critical nods from Schlumberger, Halliburton, Baker Hughes, and Petroleum Development Oman (PDO).

The importance of these approvals cannot be overstated. Gaining acceptance as a vendor to world-leading oilfield service companies is a powerful de-risking mechanism for FCL’s entry into this new, high-barrier-to-entry industry. These certifications are difficult to obtain, as they mandate that FCL’s products meet extremely stringent global operational, safety, and quality standards, effectively validating the quality of FCL’s internal R&D and manufacturing processes. This validation signals that initial large-scale order inflows are a near-term certainty, solidifying the assessment that Oil & Gas is set to become FCL’s “Future Growth Engine”.

The Engine Room: Scaling Capacity for New Orders

Translating vendor approvals into tangible revenue requires scalable manufacturing capacity. This physical capacity is provided by the Phase 1 commissioning of the new Ambernath plant. This facility adds a crucial 15,000 MTPA of fungible capacity.

The fungibility of this capacity meaning it can be quickly adapted to produce chemicals for oil & gas, water treatment, or even specialized textiles provides immense operational agility. Fineotex Chemical Stock Gain Today 1100% can quickly reallocate resources to whichever segment offers the highest margin at any given time, significantly mitigating cyclical risk inherent in relying on a single end-market. Management anticipates that this plant will begin contributing meaningfully to revenues from 2026, particularly as oil & gas chemical orders scale up.

Furthermore, Fineotex Chemical Stock Gain Today 1100% is not relying solely on organic growth. The management has communicated an aggressive, high-conviction plan to pursue an acquisition in the Oil & Gas chemical space, expected to be completed within FY26. This inorganic strategy demonstrates an urgent, high-conviction push to scale capabilities and footprint rapidly within this critical new vertical.

Demonstrating Sustained Financial Strength

Fineotex Chemical Stock Gain Today 1100% has exhibited consistent and robust financial growth, underscoring the resilience of its business model. Over a four-year period, the company demonstrated a sharp increase in sales, rising from ₹129.48 crore in March 2021 to ₹439.22 crore in March 2025. This sustained revenue growth was mirrored by proportional profit after tax (PAT) expansion. This foundational strength continued into the recent quarter (Q1FY26), where the company reported a revenue growth of 14.43% and an even more impressive surge in Profit After Tax (PAT) of 24.34%.

Despite this strong operational performance, Fineotex Chemical Stock Gain Today 1100% currently trades at a P/E multiple of approximately 36.8x, which analysts note is lower than the sectoral average P/E of 44.5x. This relative valuation discount suggests that the market may not yet have fully priced in the long-term, high-margin potential offered by the strategic diversification into industrial specialty chemicals.

Navigating Headwinds and Margin Pressure

A Fineotex Chemical Stock Gain Today 1100% balanced assessment acknowledges that Fineotex Chemical Stock Gain Today 1100% is navigating external headwinds. Analysts have pointed out softness in the FMCG and Hygiene segment, coupled with “persistent delay in export orders amid geopolitical disruptions”. Furthermore, the company has faced margin headwinds due to the necessary ‘front-loading’ of operating expenses, likely related to the commissioning of the new Ambernath plant, increased R&D for the new industrial chemicals, and meeting stringent international compliance standards. These factors led to cautionary downward revisions in FY26E/FY27E EPS estimates by some analysts.

However, there is an interesting operational contradiction emerging: the company’s delivery of a strong 24.34% PAT growth in Q1FY26 suggests that FCL’s ability to manage costs and maintain operational strength is currently buffering external shocks and exceeding cautious market expectations. The core investment thesis remains constructive, relying on the high-potential Oil & Gas and Water Treatment segments to significantly scale up and improve the overall margin profile by FY27, thereby absorbing these temporary operational costs.

The Long-Term Investment Thesis and Milestones

Fineotex Chemical Stock Gain Today 1100%’s trajectory is underpinned by management’s vision of transitioning the firm from a specialized textile auxiliary provider into a diversified, global specialty chemical powerhouse, strongly aligned with India’s long-term manufacturing goals.

For long-term investors, the focus must shift entirely from the noise of the stock split to the execution of the diversification blueprint. Key milestones that will determine FCL’s successful re-rating and sustained growth include:

Inorganic Acceleration: Successful completion and strategic integration of the targeted Oil & Gas acquisition within FY26, Commercialization: Converting the critical vendor approvals (Schlumberger, Halliburton, PDO) into sustained, large-scale commercial purchase orders, Capacity Utilization: Achieving the promised “meaningful revenue contribution” from the Ambernath plant starting in 2026, confirming the scalability of the industrial segment.

The Expert Verdict: Aligning Stock Noise with Business Substance

We began by examining the spectacular but misleading headline of a 1,100% surge, confirming it was a technical market event designed to increase stock accessibility. We conclude with the true story: a calculated strategic transformation underway at Fineotex Chemical Ltd.

Fineotex Chemical Stock Gain Today 1100% is operating like a multi-stage rocket. The reliable core textile chemical business, structurally supported by favorable government policies like the PLI scheme and premium global sustainability partnerships (Eurodye-CTC), acts as the robust first stage, providing stable revenue and margins. The company’s calculated pivot into the high-margin industrial specialty segments of Oil & Gas and Water Treatment, backed by globally recognized vendor approvals and dedicated, fungible capacity at the Ambernath plant, represents the high-thrust second stage. This strategic move is designed to propel FCL into a new, higher orbit of profitability and valuation multiples, shifting the company away from being perceived merely as a textile auxiliary firm and toward recognition as an industrial specialty chemical leader.

The Fineotex Chemical Stock Gain Today 1100% corporate actions the bonus issue and split were not the main event but a highly successful prelude that democratized access to the stock. The substantive investment opportunity now lies entirely in monitoring the diligent execution of the Oil & Gas pivot and the scaling of the Ambernath capacity. FCL’s journey is a compelling case study of a legacy company leveraging its engineering expertise and strategic planning to transition into a global specialty chemical powerhouse, offering substantial long-term growth potential for investors who prioritize fundamental strategy over temporary market sensationalism.